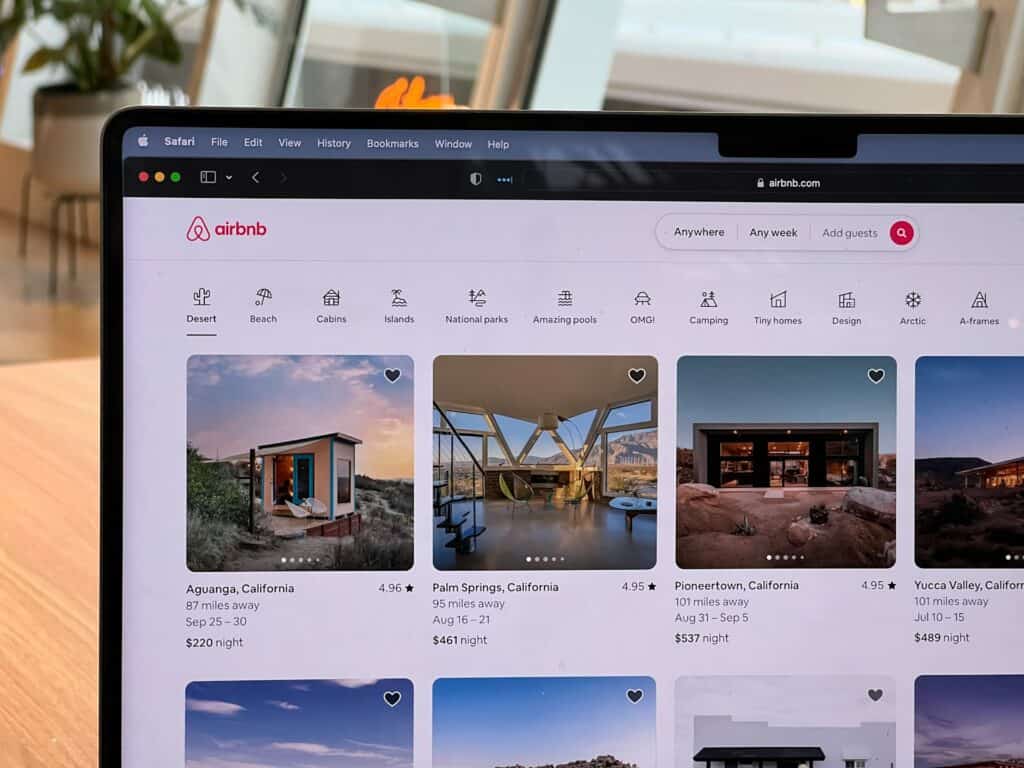

Photo by Oberon Copeland @veryinformed.com on Unsplash

A corporation purchased a condo as an investment property. For the first 9 years, it rented the condo under long-term leases. However, for the last 14 months, it offered the condo through the Airbnb platform under short-term leases. The corporation was later assessed by the CRA for failing to collect the GST/HST on the sale of the condo. The issue before the Tax Court of Canada was whether the sale of the condo was subject to the GST.

The corporation argued that it was not required to collect the GST because the sale of the condo was an “exempt supply”. The corporation rented the condo under long-term leases. It changed to short-term leases only for a short timeframe, which should not trigger the change of use rules. Specifically, the corporation argued that the change of use rules did not apply because during the time it owned the condo, the condo was used less than 10% of the time for short-term leases. (There is a provision under the Excise Tax Act (“ETA”) dealing with “insignificant” changes of use, which will be discussed later.)

The Court disagreed with both of the corporation’s arguments.

With regard to the first argument, the court found that, at the time of the sale, the condo was not a “residential complex” because (1) it was offered for short-term leases on Airbnb, which put it on the same footing as hotels, motels, inns, boarding houses and lodging houses; and (2) all or substantially all of the leases were for periods of less than 60 days. Because the condo did not meet the definition of “residential complex”, the sale of the condo could not qualify as an “exempt supply”.

With regard to the second argument, the court disagreed that the condo was used less than 10% of the time for short-term leases. To put this issue in context, there is a rule under the ETA that deems a registrant to have received a supply of a property by way of sale when a property initially acquired for other purposes is later used as capital property in the commercial activities of the registrant. Except where the property is an exempt supply, the registrant is deemed to have paid tax in respect of the supply equal to its “basic tax content” (a term defined in the ETA). However, this rule is not applicable when the change of use is less than 10%, which is what the corporation argued. According to the corporation, because the change of use was less than 10%, the condo preserved its initial character as a “residential complex”, which qualified the sale of the condo as an “exempt supply”. The Court disagreed. The 10% is not calculated by looking at the length of ownership of the condo, but rather at the moment the condo was used more than 10% of the time for short-term leases. When the corporation listed the condo on Airbnb, its use became 100% commercial. The change of use happened at that moment.